Upi paynow

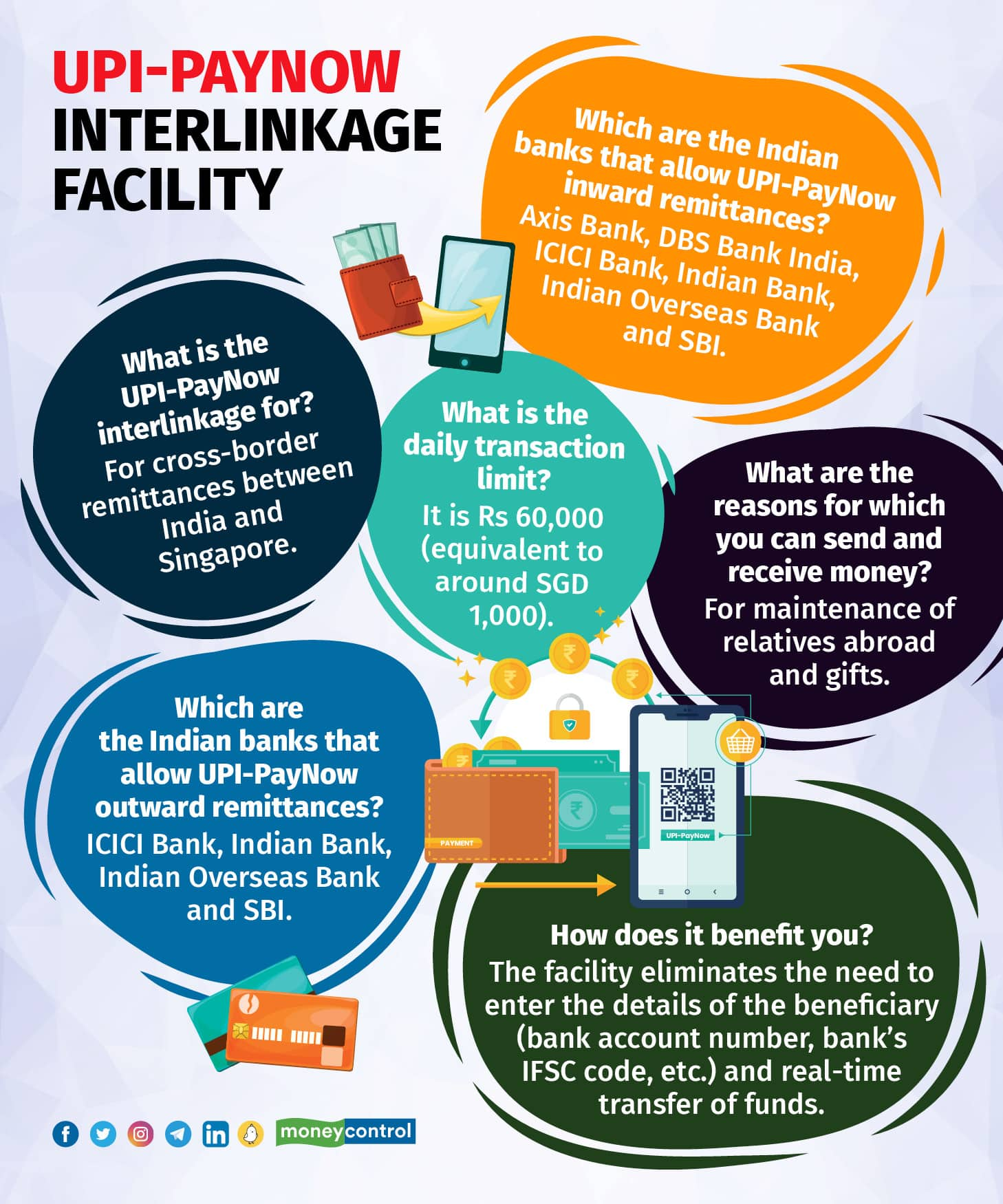

UPI Lite lets users carry out quick and seamless transactions of value up to Rs 200 at a time. India and Singapore on Tuesday linked.

Jyfdzcxsxe Qcm

Web On Tuesday UPI-PayNow was officially launched by Singapores PM Lee Hsien Loong and Indias PM Narendra Modi.

. Web The facility was launched through token transactions using the UPI-PayNow linkage. We all know how UPI revolutionised domestic payments and we are now going. Web India and Singapore have linked their digital payments systems UPI and PayNow to enable instant and low-cost fund transfers in a major push to disrupt the.

Web The PayNow-UPI linkage will enable users to make instant low cost fund transfers directly from one bank account to another between Singapore and India. Web Indias UPI to be linked with Singapores digital payments platform PayNow. Customers can undertake cross-border remittances to Singapore using the banks mobile banking app internet banking.

With just a mobile number users can send and receive funds from one bank. Web 37 minutes agoThe focus here is on small-value UPI transactions. UPI linked to Singapores PayNow for fast transfers.

Web 1 day agoIndia has officially linked its flagship online payment system UPI with PayNow the online payment system of Singapore for seamless cross-border transactions. Web 2 days ago1 min read. Web 2 days agoThe initiative of linkage between Indias Unified Payments Interface UPI and Singapores PayNow by the Indian Government is a crucial development in the nations.

PM Modi called the venture a new milestone in relations between the two. A collaboration project of Indias Reserve. 21 Feb 2023 1123 PM IST Shayan Ghosh.

Delighted to launch the linkage between PayNow and. Web 2 days agoUPI-PayNow Linkage 2023. Starting today Indians will be able to use UPI to make faster easier and cheaper.

Web Similar to Indias fast payment system - UPI - PayNow is Singapores counterpart. Web The UPI-PayNow linkage will now enable users to make faster payments at low-cost on a reciprocal basis without the need to use any other payment systems. Web According to the RBI press release The UPI-PayNow linkage is the product of extensive collaboration between Reserve Bank of India RBI Monetary Authority of.

Web 2 days ago24 hours ago. Web 2 days agoThe UPI-PayNow interlinkage is a milestone moment for cross-border transfers. Web The PayNow-UPI tie-up is the first of its kind to use scalable cloud-based infrastructure that can accommodate future increases in the volume of remittance traffic.

Web 2 days agoUPI-PayNow transfer limits. Indias Unified Payments Interface UPI and Singapores PayNow have been linked for cross-border money transfers the Reserve Bank of India. Web 2 days agoUPI payments through QR codes are already taking place in Singapore though at a limited number of outlets.

Web 2 days agoThe UPI-PayNow linkage will enable all users of the two payment systems in either country to make convenient safe instant and cost-effective cross-border money. Web The UPI-PayNow linkage is a significant milestone in the development of infrastructure for cross-border payments between India and Singapore and closely aligns. With the launch of the Real-Time payment Systems Linkage between India and Singapore today customers of participating banks.

Web 1 day agoThe PayNow-UPI real-time cross-border payments linkage is the result of extensive collaboration between MAS RBI payment system operators in both countries.

Qki Asljd2cwom

Poffiyyk7vw6gm

Fervs4x1 I841m

89myacskztvtzm

Iniq4h0rca3chm

7g9uz3fw3qgvcm

Ncrgr Ijnzonem

9yltsbc6unbcfm

O53nlbtlizhkxm

Nz7wewdypqhbnm

/newsdrum-in/media/media_files/I4ktBaK5xnriFRO0TH6A.jpg)

Pcuoklir0jzbmm

Wotcscgimiykfm

2 6dalhc84p7xm

Dfrwdujb6errrm

7e95bywgqtbw M

9i4wkmiwppmdgm

Yr4y0z1fwxu2 M